Shoe retailer Deichmann supports site selection with Targomo’s Location Intelligence Platform

Comments Off on Shoe retailer Deichmann supports site selection with Targomo’s Location Intelligence Platform

Comments Off on Shoe retailer Deichmann supports site selection with Targomo’s Location Intelligence Platform

Comments Off on Deichmann selects locations with AI

Comments Off on Deichmann uses location intelligence

Comments Off on Deichmann-Gruppe setzt Targomos Location Intelligence Plattform ein

SERIES: RETAIL TRENDS THAT ACCELERATED DURING THE PANDEMIC

The pandemic has hit few other industries as hard as retail and out-of-home dining and drinking. Stores, restaurants and bars had to close virtually overnight and were only allowed to reopen, if at all, under tight restrictions. To cope with this situation, businesses have adapted and introduced new concepts and sales models. Consumers have also changed their shopping habits, reinforcing existing and breeding new retail trends. These developments appear to permanently alter the role of brick-and-mortar stores.

In this new series, we’ll discuss some of the retail trends, which are likely to be part of the “new normal”. The first big trend: Grocery delivery – when possible, within 10 minutes.

One of the New Retail’s hallmarks is convenience. Grocery delivery, long present before the pandemic erupted in 2020, has been one of the main beneficiaries of this need. Both new order & delivery services as well as classic supermarket chains have tailored to increased demand for at-home deliveries of grocery products.

Some people simply don’t want to wait in line, others dislike finding empty shelves. When the pandemic hit, some didn’t want to visit any stores because of infection risks. Ordering online and getting it brought to your home has been the easy, safe answer. A single figure shows how the service has skyrocketed the past twelve months: Globally, there were more than 550 million downloads for food and drink apps in Google’s Play Store between March 2020 and April 2021, a 33% percent year-on-year increase. Experts estimate that 10% to 15% of US grocery sales moved online at the height of the pandemic last year, as much as five times pre-covid levels.

Clearly, quick grocery delivery offered by new retail entrants Gorillas, Gopuff, Weezy and others have seen a stellar rise during the pandemic. They are rapidly expanding across cities in Europe, the US and elsewhere. Early May, US-based Gopuff announced the acquisition of British peer Fancy. Some of them have already reached unicorn status ($1+ billion valuation) and set new records. Berlin-based Gorillas attained the much coveted valuation level in March, only ten months after its founding. It was the shortest time for any German startup to become a unicorn, and possibly in Europe. And that’s not all: Gorillas is currently in talks for a $500 million funding round, valuing the company at more than $6 billion, Bloomberg has reported.

The high valuations and the intense interest in these new startups comes with a simple, but bold promise: Grocery deliveries in as little as 10 minutes. It is a radical break with 1- or 2-day delivery, the old norm of traditional supermarkets.

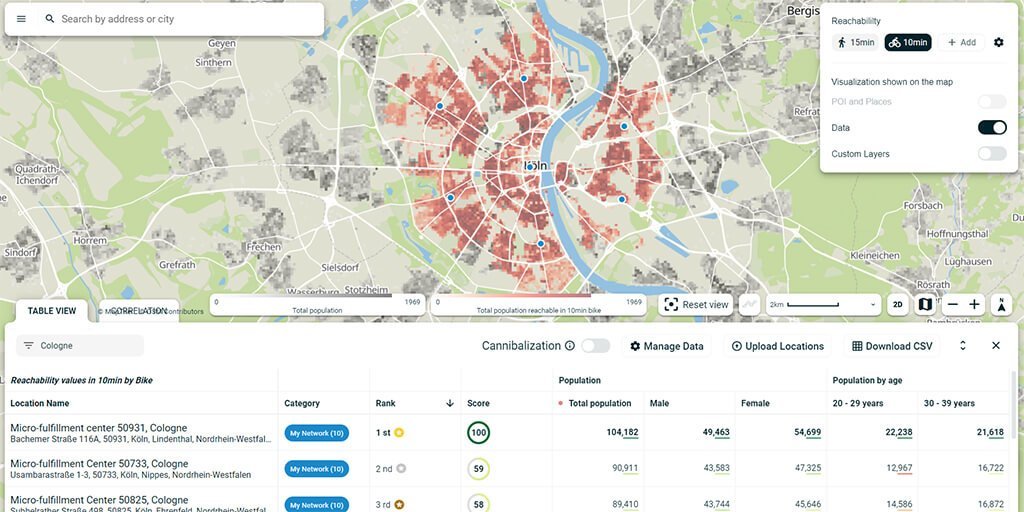

To keep their pledge of instant shipments, the startups are building up a novel network fulfillment and delivery centers. The new retailers operate so-called dark stores located in areas with a high population density. Dark stores are relatively small, local warehouses and are not open to visitors. They are also known as micro-fulfillment centers, from which orders are immediately processed and dispatched to the consumer as soon as orders come in. Contrary to large logistics centers on the outskirts of town, these dark stores are located in the neighborhoods where people live, guaranteeing ultra-short delivery times.

Consumer’s demand for convenience and instant delivery has also pushed the incumbents to offer quick commerce services. In the UK, discounter Aldi and upmarket supermarket chain Waitrose have picked meal delivery company Deliveroo to offer delivery of groceries in 20 or 30 minutes. In the US, online order & delivery apps like Instacart and Shipt allow consumers to order from dozens of shops such as Whole Foods, Target and CSV, and get them shipped in as little as an hour.

The rise of instant delivery has even prompted sformer players to return to the German home market with meal and grocery deliveries. Delivery Hero, the world’s biggest meal delivery company, had sold all of its German operations in 2018 to focus on emerging markets. But last week, the Berlin-based company announced it would launch its quick commerce service Foodpanda in Berlin and other German cities.Delivery Hero has also stepped up its game, promising delivery of food and non-food items in as fast as 7 minutes. It will partner with local restaurants and stores, as well as operate its own dark stores, which Delivery Hero calls Dmarts, or “dark markets”.

The move will further intensify competition in a nascent market. Experts think that eventually less than a handful of local players will survive. The winners need to corner the market with an optimal fulfillment network, a superfast delivery service and the right product mix.

All these developments, from young startups like Gorillas to decades-old family businesses like Aldi, imply that instant grocery delivery and the rise of micro-fulfillment centers will continue to spread – even when the pandemic has passed.

Location intelligence enables retailers to identify the best locations for micro-fulfillment centers and reach the optimal market penetration for entire networks. Book a demo to learn more.

Comments Off on Grocery Delivery: Of Dark Stores and Micro-Fulfillment

Comments Off on Gruenderszene Interview: Targomo CEO talks about winning the EIT Digital Challenge and international expansion

Use detailed catchment area, demographic and spending power analyses to set up the most efficient network of micro-fulfillment centers and meet delivery deadlines.

Comments Off on Identify the Optimal Locations for Micro-Fulfillment Centers

Comments Off on EIT Digital Challenge awards the 5 best European digital deep tech scaleups of 2020

Comments Off on Germany’s Retail Association Handelsverband Deutschland Includes Targomo’s Technology in AI Pages

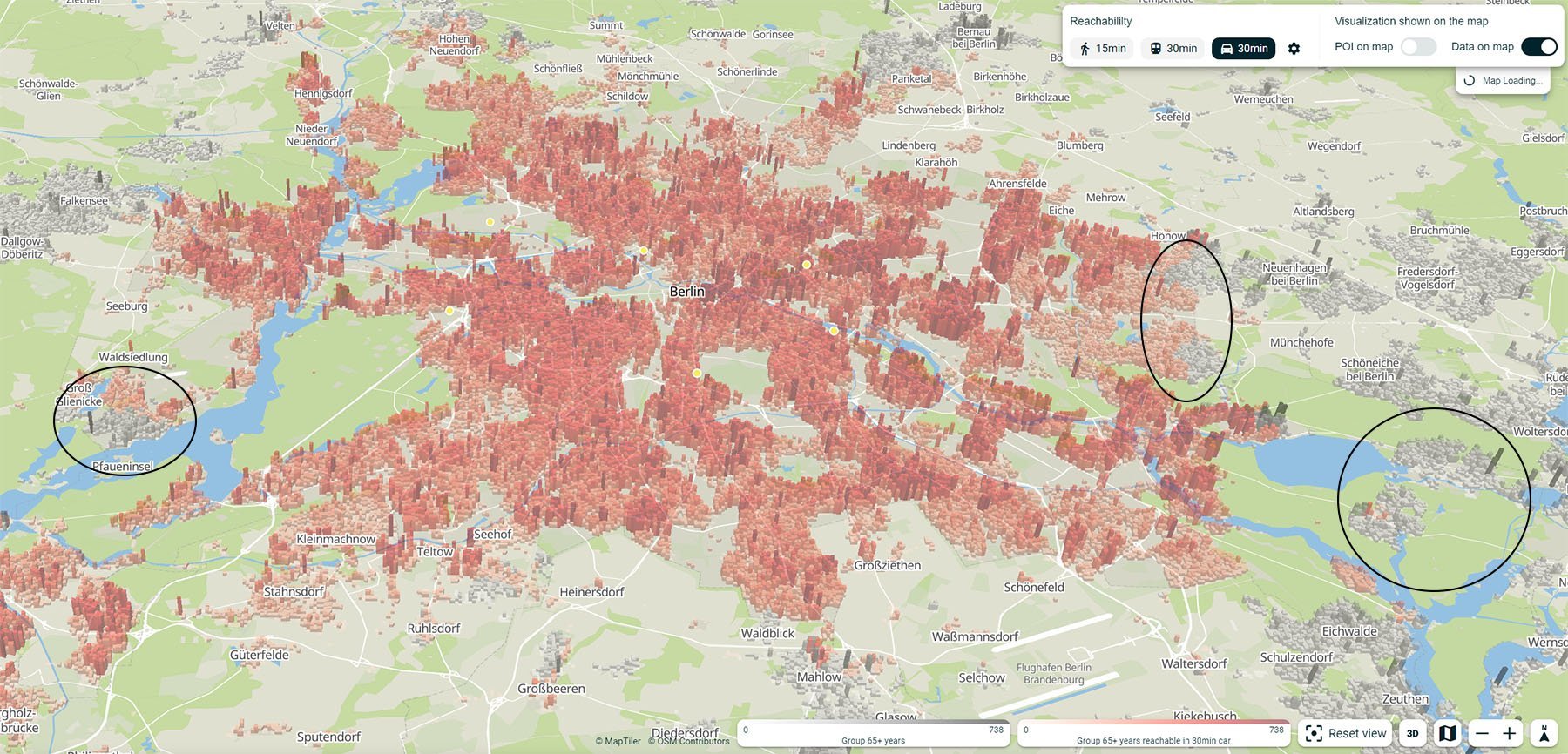

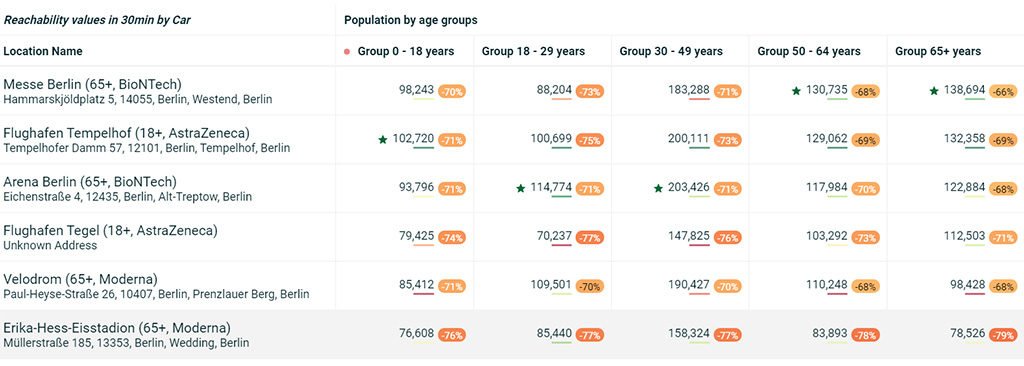

The German capital has placed its vaccination centers at central sites in the city. We wanted to know how easily people aged 65 and up would be able to reach these locations. It turns out that around 95 percent of Berlin’s seniors can reach a center in 30 minutes by car.

Since the end of December, Germany has been vaccinating its citizens aged 65 and older. People over 70 years are entitled to a return trip by taxi, paid for by the local government. Many people who live in elderly homes can also get a vaccination at home thanks to mobile teams, who inoculate seniors where they live.

Because there is no data about how many seniors are eligible to receive vaccination at home, we have assumed that all people need to visit one of the six centers. We wanted to know how much time it would take for all Berlin seniors of 65 and older – 700,000 in total – to reach one of the vaccination locations. We used the locations of Berlin’s six vaccination centers, demographic data and a reachability calculations available in location intelligence platform TargomoLOOP.

We’ve found that the majority of people can reach an inoculation center in a maximum 30-minute car drive. Only a few hundred in pockets in the west, east, and south-east would need up to 40 minutes by car to reach the nearest vaccination location. These are the highlighted areas in the picture at the top.

The table below shows the result for different age groups. The total for the age group 65 and up is 683,393, but this figure also includes seniors who do not live in Berlin. Based on Berlin’s total senior population of 699,564 at the end of 2018 it means that 97.7 percent of them can reach a vaccination center within 30 minutes by car. The actual percentage will be a bit lower, because of the non-Berliners included in the 683,393 figure.

We’ve also looked at public transportation as the travel mode, and then the travel time increases for many senior citizens. Most of them could reach a center within an hour. Only a couple of dozen people in the south-east (Müggelheim, Rauchfangswerder, Altes Fischerdorf) would need a little longer. Obviously, many seniors will likely not take public transportation because of the infection risk, and the option to take a free taxi ride for people aged 71 or older.

The analysis above has been done with analytics platform TargomoLOOP. The basic version is free of charge and allows users to quickly gain insights into their locations. Curious to see the platform in action? Simply sign up and start analyzing.

Location analytics platform TargomoLOOP supports managers in retail, food service, real estate, public services and logistics to analyze locations and quickly see their potential in terms of catchment area, customer base and reachability. AI-powered predictive analytics allows retailers to identify the success factors of a network of stores and predict the revenue potential of new locations. These insights help managers to plan and optimize their branch network.

The platform’s basic version offers essential features to analyze locations with maps, demographics, and reachable places (also known as Points of Interest). Users can easily rank locations by category and weight. They can correlate location variables with performance. Users can analyze an unlimited number of locations and download reports of their findings. No set-up is required: Simply register, type in an address, and get results within seconds. Everyone can start analyzing for free.

Comments Off on Coronavirus Vaccination in Berlin: Can Senior Citizens Easily Reach Inoculation Centers?