- Products

- TargomoLOOP

One Platform, Unlimited Insights

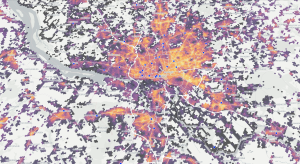

- GeoAI

Turn Data into Accurate Forecasts

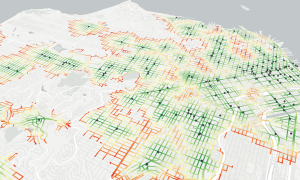

- TargomoAPI

Build Powerful Mapping and Location Analytics Applications

- Data

Global Data. Local Insights. Smart Decisions

One Platform, Unlimited Insights

Trusted by the world’s leading brands

- IndustriesLet us help!Can’t find your industry on our list?If your business has multiple locations or physical touchpoints, we can help!

- Resources

- About Us

Login

Book a demo