With the rise in rapid grocery delivery, dark stores have emerged as fulfilment centres placed close to large populations for ultra-quick orders. But how are they different from supermarkets, how do you plan a dark store, and what does the future hold?

By 2023, e-commerce sales are expected to hit $6.5 trillion. That’s more than the GDP of Germany and India combined. In fact, in the five years between 2021 and 2026, e-commerce is expected to grow by 55% globally.

The world was always going this way, but the Covid pandemic certainly helped accelerate the change. According to Capgemini research, online sales in the UK surged 61.8% year-on-year during Covid, with Amazon sales in the UK up 81% in 2020 compared to the year before.

With such unprecedented change comes new opportunities and infrastructure to service these growing demands for near-instant delivery. One of those is the concept of the “dark store”, a term probably unfamiliar to most but which anyone who has ordered online will have had some touchpoint with.

What are dark stores?

Similar in layout to a supermarket, dark stores are brick-and-mortar warehouses laid out in aisles and stocked to the rafters with goods. But that’s where the similarities between the two ends.

Generally not open to the public, though some do act as click-and-collect centres, dark stores have emerged out of consumers’ unprecedented appetite for convenience and online shopping. Put in a quick commerce order, and the chances are it will be fulfilled at a dark store, and sent to you quite possibly the same day.

Another key difference between a supermarket, in the traditional sense, and a dark store are their catchment areas, and how that is defined. With a supermarket, its catchment area is estimated, because its customers can ebb and flow. In other words, the buyer goes to the seller, and they use many different forms of transport to get there, so accessible multi-modal transport routes have to be taken into consideration when defining the catchment area. Supermarkets are also situated to take advantage of passing trade, often near complementary businesses where customers can visit multiple shops from one area.

With dark stores, the opposite is true. The seller goes to the buyer, mostly fulfilled by a delivery agent who will bring the purchase to your home or business address. Because of this, the dark store can accurately determine what its catchment area is. This is defined by three elements: the dark store location (within the proximity of a wide range of potential customers), the type of transport used (mostly vehicles or e-bikes), and the promised delivery time.

Where are the best locations for dark stores?

Like supermarkets, location is crucial for dark stores. But while supermarkets have to take into consideration multi-modal transport and high foot traffic, for dark stores the data foundation when it comes to a decision for or against a location is different. It’s much more important to be placed strategically and geographically in order to service areas with high population densities and the right demographic profile, quickly.

Space requirements can also be different. Dark stores don’t have to lay out stores based on customer psychology. In a supermarket, for instance, fresh produce is placed near the front, and promotional items on the end of aisles. Instead, dark stores can maximise the space to their full advantage. For example, prioritising items that are frequently ordered by making them easier to reach and closer to the front of the store for even more efficient delivery.

As we know, close proximity to the customer base is key to fulfilling promises of speedy delivery. But with many micro-fulfilment zones placed in close proximity, there’s a danger of cannibalisation through overlapping delivery or fulfilment zones.

How location technology can help plan dark stores

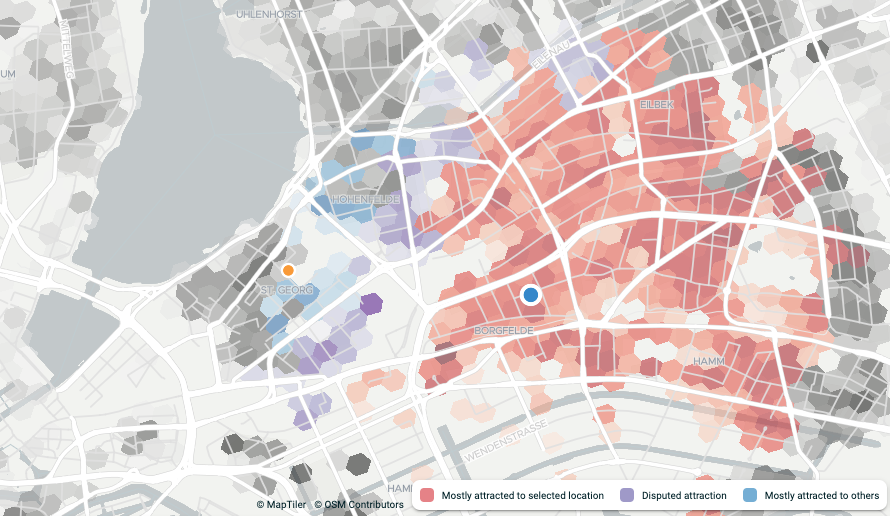

This is where location technology can help. With tools such as TargomoLoop you can really drill into the detail of your chosen area, from catchment size, to demographic data, allowing you to accurately pinpoint your potential market, creating zones that work in harmony with each other, and potentially avoid cannibalisation.

Analytics tools like TargomoLOOP can make cannibalization visible. Affected and sensitive areas are marked here in blue and purple.

A great example of this is Yababa, a grocery company that specialises in Turkish and Middle Eastern products. Using our powerful demographic location data, it was able to determine the optimum sites from which to service its unique customer base in Berlin, Cologne and Düsseldorf, Germany.

Our software can also allow you to optimise based on other demographic criteria, such as household size, purchasing power and consumer profiles. For instance, if you are targeting younger customers with higher incomes, you can find out where these people are in relation to your store, and how many you can deliver to within an allotted time.

Dark stores in the future

In the restaurant industry, the concept of ‘Ghost kitchens’ has been around for a few years now. They allow restaurants or fast food outlets that don’t have a physical location with guest space, to service customers from kitchens with delivery-only or kerbside pick-up locations. The same principle is now appearing in other industries. Supermarket chain Kroger and tech platform Ocado have partnered to help Kroger expand into territories where it currently doesn’t have a presence, and without the need to create expensive public-friendly brick-and-mortar stores.

Then there’s the hybrid model, where online and offline sales merge under one roof. Alibaba has been trialling this concept in China with its smart supermarket Hema. Here, customers can browse physical products, scan them to purchase, have them delivered while they shop and even order food to be cooked and be ready for the end of their shopping trip.

Gorillas, an app-based delivery company with presence in Europe and the United States, uses Targomo to plan delivery zones and map fulfilment areas. Recently it added in-store pick-up as an option, reports the New York Post. At its 18 locations in New York, customers can now order online and pick-up in store at a time that suits them.

In Germany, supermarket chain REWE is doing something similar, introducing collection stations that are open 24/7 and allow people to pick up groceries that they have previously ordered on the app.

While e-commerce sales are booming, consumer demand for instant shopping gratification and the chance to connect more physically with their purchases means a hybrid model where we see the supermarket and dark store merge could be the next big revolution in the world of retail.

Discover how the power of location intelligence could help you plan your next retail location.

Comments